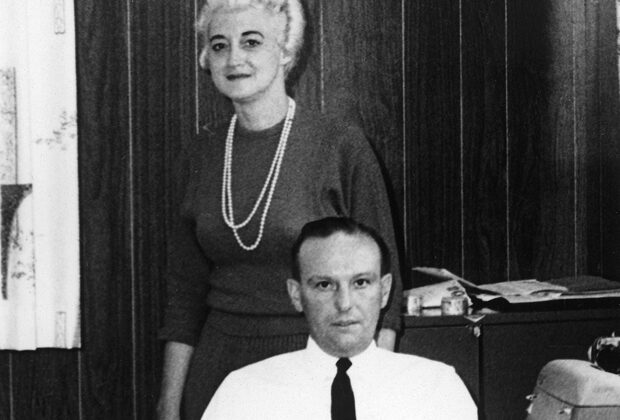

Origin in Motorsports: Decades before K&K Insurance became a leading provider of sports, leisure, and entertainment insurance, its co-founder, Fort Wayne, IN businessman Nord Krauskopf, was a popular stock car racer. In the late '40s, the only insurance for this high-risk sport consisted of individual racers contributing to a fund that would help cover the costs in the event of an accident. Aware of a gap in the market, Krauskopf and his wife Teddi pitched a plan to Lloyd’s of London to create specialized insurance for race car drivers. Eighteen years after launching K&K Insurance for this purpose in 1952, their dedication to motorsports resulted in winning the Grand National Championship. In the '60s and '70s, they expanded into festival and fair insurance, and in the '80s took a broader approach that included sports, leisure, and event organization across the U.S. and Canada. Over the past 70+ years, K&K has also become one of the largest providers of insurance and claims resolution services for recreation, motorsports, and event organizations. Driven by their trademarked branding motto “Insuring the World’s Fun,” the company offers over 80 specialty insurance programs in numerous categories—ranging from Camps and Campgrounds, Events and Attractions, and Venues and Facilities to Instructors, Schools and Product Liability Insurance.

Essential Operations: Staffed with experienced examiners, litigation specialists, and management personnel, K&K’s claims team offers decades of experience in the investigation and resolution of claims, providing quality claims management. The company employs more than 250 agents who perform a variety of traditional insurance company functions on behalf of the insurance companies they represent, allowing them to provide stellar service in sales, marketing, underwriting, loss control, and claims resolution. Through active involvement in industry associations, events, and conventions, its staff stays connected with current industry trends and challenges.

Liability Insurance for Musicians: According to K&K Marketing Manager Lorena Hatfield, the company’s claims staff is well versed on the types of risks musicians face when they’re performing at an event, festival, or concert venue. If something should happen that prompts an audience member or facility owner to sue, the performers are often drawn into the lawsuit—and without insurance, they need to hire an attorney to determine liability. Whether it’s injury or property damage, with insurance coverage, K&K manages the process, reducing a musician’s stress considerably. Many facilities require this coverage in advance. There are three criteria for insuring musicians: 1) A group must have at least one member or representative who is at least 18 years old; 2) Annual gross income from the performing group’s activities cannot exceed $500,000 ($300,000 for an individual musician); and 3) No more than 30 members in a performing group. Coverage options are offered for both individual Performer’s Insurance and Entertainer and Musicians (Group) Program.

Contact K&K Insurance Group, Inc. 800-637-4757