When it comes to the outlook for the music industry in 2021, there’s a fitting quote that is often attributed to Mark Twain: “History does not repeat itself, but it rhymes.”

After enduring a recession caused by the COVID-19 pandemic, the music industry can look to the new year with a combination of caution and optimism. While the coronavirus will negatively impact the economy for at least several more months, a rapidly scaled up vaccination program should begin to bear fruit later in the year. Once the collective health of our country is on a steady track to improvement, which many health officials think will be late summer or early fall, the music industry should be on the road to recovery.

The Impact of the Pandemic

Returning to “normal” can’t come soon enough, especially for independent recording artists, songwriters and many others involved in creating and performing music. The Nashville Chamber of Commerce’s recently released 2020 Music Industry Report, which compares Nashville to the top 10 music industry markets in the U.S., illustrates how severely the pandemic has decimated our industry. Here’s a sampling of how COVID-19 has affected the Music City:

Music Creators and Performers

- 3% of music creators have lost scheduled gigs, studio work or residency.

- 4% of musicians surveyed have experienced unemployment since March; 96% due to COVID-19.

- 5% of music creators are making less music because of COVID-19.

- 5% say COVID-19 has negatively impacted their mental health.

- 4% of recording artists have performed zero times since March 2020.

Live Music Professionals (excluding artists)

- 96% surveyed are seeing less work, with 43% not able to transition to remote work.

- COVID-19 will decrease 2020 annual income for 93% of survey respondents.

Small Business Owners

- 7% lost revenue since the onset of COVID-19.

- 50% anticipate their companies bouncing back in one-to-two years.

Taming the coronavirus will allow businesses to restart and get people back to work. According to the Music Industry Report, an estimated 2.8 million people were employed in the music and music-related businesses in the U.S. in 2019, 5.2% more than were working in 2013. Those jobs generated $174.5 billion in wages, 17% higher than in 2013. The total economic impact jumped 9.2% to $514 billion from 2013 to 2019.

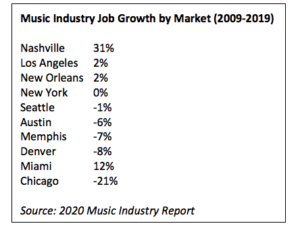

Nashville’s standing in the U.S. music industry continues to grow. During the period 2009-2019, music industry jobs increased 31% to 8,779, according to the Music Industry Report. In comparison, Los Angeles––the largest market for music industry employment––jobs growth inched ahead 2% and New York (#2) was unchanged at 18,074.

Those jobs are essential to the economic health of each of those markets. In Nashville, my hometown, music and entertainment businesses were responsible for 80,757 jobs that generated employee compensation of $6.3 billion and added $15.6 billion to the state’s GDP in 2019. In 2013, employee compensation was about half that ($3.2 billion) and GDP was more than 60% higher ($9.7 billion).

Federal Stimulus Package to Aid Music Industry

Recognizing that our nation’s economy is not out of the woods due to the pandemic, Congress passed legislation to provide more funding to help cash-strapped businesses. The $900 billion stimulus bill includes several provisions – more Paycheck Protection Program (PPP) funding and new aid for live entertainment venues––that will support smaller, independent music and entertainment businesses.

Paycheck Protection Program Renewed

Lawmakers approved $285 billion for a new round of PPP funds that will be granted primarily to small businesses. Funds are available only to companies with fewer than 300 employees that have had a minimal 25% decrease in revenue for at least one quarter. Loans are capped at $2 million.

PPP funding was a financial lifeline for the music industry last year – and will be again in 2021. Our bank’s Music Industry and Private Client Services groups, for example, processed more than 300 PPP loans worth a total of around $40 million. Many of those dollars went to small businesses––from sole proprietorships to companies with 100 employees––in the music and entertainment industries. Businesses included music venues, artist management firms, festival companies, tour bus operators, staging and lighting vendors, booking agencies and music publishers.

New Save Our Stages Act Supports Live Events Businesses

Also included in the stimulus package is the Save Our Stages Act, which provides approximately $15 billion in funding for independent music venues, movie theaters and similar cultural institutions that have been essentially closed for business since March 2020. This program allows businesses and organizations to apply for Small Business Administration grants to cover six months of payroll and operating costs, including rent, utilities and maintenance. To qualify, applicants will have to prove the business lost at least 25% of their annual revenue. Grants are expected to be capped at $10 million and publicly traded companies and other large businesses will not be eligible.

Crowdfunding Still a Fundraising Option

While businesses were eligible to participate in federal aid programs, recording artists and performers didn’t have that option and tapped into another source of capital to pay the bills: crowdfunding. The Music Industry Report found that 47% of survey respondents said they participated in crowdfunding or made a donation to support an artist during the pandemic.

Many recording artists, performers and songwriters have successfully raised money on sites such as Go Fund Me, Indiegogo and Kickstarter. That likely will continue in 2021. Songwriters and recording artists, however, should approach crowdfunding with caution. The time and effort to raise funds and meet current and future obligations required to fulfill a crowdfunding commitment may be better spent building a social media presence and marketing new music to fans.

Virtual Events Are Here to Stay

While stimulus funds will provide welcome financial relief to the industry, social distancing and similar public health requirements will limit opportunities to record music in the studio and perform in music venues and clubs. To stay top-of-mind with fans, artists will need to stay connected virtually. The savviest performers will expand their online presence through social media (Facebook, Twitter and YouTube) and the major streaming platforms (Spotify and Apple Music). They will also continue experimenting with live virtual events and, when applicable, socially distant performances for small audiences.

These virtual events are strengthening interactions with fans and bringing in much-needed revenue. What was initially considered a stop-gap effort to generate income will now be part of many artist’s revenue streams to complement traditional live events.

Creators’ Work Will Increase in Value

One trend we see continuing in 2021 is an increase in the value of music copyrights. The sustained – and impressive – growth of music streaming is one contributor. Streaming initially dipped during the onset of the pandemic, but ended up increasing 17% to a record 872.6 billion streams in the U.S. last year, according to MRC Data.

Another key reason is the income generated from copyrights has become an attractive alternative to investments in fixed income securities. Investors can earn more money from the catalog than, for example, high-quality bonds. Artists such as Bob Dylan and Stevie Nicks took advantage of heightened investor demand and sold their catalogs last year. It’s expected that more artists will follow suit.

There’s a well-known saying about the music business in Nashville: “It all starts with a song.” The music and entertainment industries will continue to face a challenging macroeconomic climate because of the pandemic. But thanks to support from the federal government and robust consumer demand for music, more songs will soon start being heard in the honky tonks of Nashville and other venues around the U.S.

ANDREW KINTZ is executive vice president of Private Client Services and the Music Industry Group at First Horizon Bank.