Artists are already signing on with AmplifyX, the first SEC and FINRA compliant platform allowing investors to directly support established and emerging artists. In an industry that has long been seen as impenetrable for investors, CEO Adam Cowherd notes that the time has never been more ripe for a surge in music investment. “The younger generation is more financially literate than ever before,” he notes. “Due to smartphones, it’s just as easy to buy a stock as it is to listen to music.”

With a platform launch date of September 9th, 2020, AmplifyX’s announcement comes at a time of anticipation for the music industry. Despite the short-term drop in revenue due to live concert cancellations across the globe, Goldman Sachs’ most recent report on the music industry predicts an overall rise to $131 billion by 2030. As investors increasingly recognize music as a valuable and reliable alternative asset class, new investment opportunities are set to play a major role in this predicted climb. Music can be a smart alternative investment as a portfolio hedge.

AmplifyX opens possibilities for direct artist-investor relations based on transparency and trust. In addition to SEC and FINRA compliance, AmplifyX evaluates emerging artists for a baseline number of online listeners, social media followers, and a core management team - metrics that indicate the likelihood of quality investments.

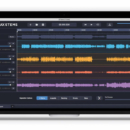

As investors build portfolios of the artists they want to support, AmplifyX’s desktop and mobile-friendly dashboard offers detailed analytics of each potential investment, including play numbers, listener paths, and catalog insights. When the time comes to make choices, investors are well-informed, armed with consumer confidence and the power to affect major change for emerging artists. “AmplifyX democratizes access to the music industry and, in turn, gives artists an alternative financing model,” Cowherd explains. For the artists, that path includes retaining control over their intellectual property and creative trajectory, as well as up to 90% of their royalties.

AmplifyX’s well-regulated artist investment ecosystem carries the promise of growth and long-term moves toward democratization in a music industry long criticized for its tendencies toward artist exploitation. As many established artists leave behind once-traditional record labels for independent ownership - a report from the Raine Group estimates that indie artists will generate $2 billion in revenue in 2020 - AmplifyX is poised to close the gap between investors and artists. “This is a piece of the solution for mainstream artists on a grand scale,” says VP of Business Development Kelli Richards, whose industry experience includes having launched and led Apple’s focus on music initially and having been a label exec at EMI Music.

That solution means a bright future for artists, investors, and listeners alike. “If [artists] have people who really care that deeply about their music, and are willing to put their money where their ears are, we’re going to see some really incredible opportunities play out for all parties,” says Cowherd. He and his team at AmplifyX are ready to open up the music industry to investors looking for a new, evergreen option - one with the power to make widespread change and open doors that have long been closed to external investors.